Stop Buying Your Cheeseburger on Credit

An answer to why everything has gotten so expensive. (Part 1/2)

Words: 1224

Reading Time: 5-6 Minutes

Imagine I stripped away all ability for you to get a loan for anything. No more loans for your kid’s college, your home, your car, or that new addition for your house that you were going to use a home equity line of credit for. Then, I cut up all your credit cards. Afterwards, I told you that you were only allowed to buy the things that you could afford with the money in your bank account.

How much would the car be that you would buy next?

How much will your next house cost? Would you decide to buy a new one at all?

What kind of university would you send your kid to?

Would you still do that addition?

Humans fear losing money today more than in the future. We are more willing to pay a small number per month, but pay more in aggregate, than we are willing to pay a large sum up front. This all stems from a neurological battle that goes on in our minds. Our prefrontal cortex, which handles long-term abstract reasoning, must fight our limbic system, which seeks immediate reward.

People are bad at this. We evolved to survive the day. We ate our kill the moment the hunt was over because we didn’t know when the next kill would come. And, frankly, we had no way of preserving it.

Immediate gratification is baked into our genetic code. And it’s why people pay every month for things they bought in the past. Things like their home, their car, their cell phone, or even their most recent meal delivery.

This is called being in debt. Debt is bad because it usually means that you couldn’t afford something that you wanted so now you have to pay more for it over time. But, according to some, debt can occasionally be good.

Good Debt

Good debt is considered good because it is usually wealth building and has low interest rates. Business debt is seen as good because it’s leveraged to build revenue that provides you with an income. A mortgage is seen as good because it helps you obtain (hopefully) appreciating real-estate assets. A student loan provides you with an education and better job opportunities when you graduate (well, they used to.)

The thing about business loans, mortgages, student loans, and car loans is they are—or at least should be—challenging to get. They typically require high credit scores, a substantial lending history, and years of sustainable income that is far more than the loan repayment costs.

But I don’t think the good debt is always all that good. When it is overused, it can become a systemic financial hazard.

Take home prices. The current state of home ownership in the U.S. is problematic, considering that the median home price is far more than most people can possibly pay with what’s in their bank account.

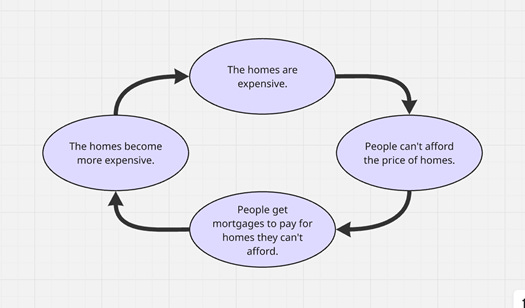

As of 2025, the median home price in America is $415,200. Because home prices are so high, people must use mortgages to buy them. And because people are willing to pay more in the future than they are willing to pay today, they are willing to pay more than they can afford for a home. This becomes a self-reinforcing loop, pushing home prices ever higher.

Then, when home prices get too high, the government often jumps in to “help” the situation, by loosening lending practices. This boost in lending usually leads to the problem of inflated home prices getting worse. And we have many such cases of this.

Help to Buy

In 2013 in Britain, the UK government created a series of programs called “Help to Buy” (HtB). These programs offered a mortgage to first-time buyers that decreased the barrier to entry for home purchase. Another goal of the program was to increase the construction of more affordable homes. So, the subsidy only applied to new construction homes under a certain price.

The program worked by offering first-time buyers a low down payment, 5% of the value of the home, and then an interest-free equity loan for the next 20% or so of the value of the home. Then, after an interest-free period, these buyers would pay their normal mortgage.

It was a messed-up system. I’m honestly probably describing it wrong. It was convoluted and stupid, as most government subsidy programs tend to be. It also had a stipulation that when these people sold their homes, they owed the government money on the original equity loan. So, they didn’t get nearly as much of the upside if the value of the home went up, and then they owed on the downside if the value of the home went down.

If that’s not bad enough, the HtB program also distorted the UK housing market.

First, prices of homes that fit the description of the program ballooned to the cap price of the program. This inflated the prices of these homes beyond the value of the subsidy.

Furthermore, builders shrank the sizes of homes to increase the profits they would make on the sale.

On top of that, construction volumes didn’t even exceed what would have been expected if the program were not to exist.

What the UK got for this program was more expensive homes of lesser quality that people now had to pay back the government for.

The HtB program ended in 2023.

HtB shows how cheap money lending in a market distorts prices. But it doesn’t just happen for homes; it happens in every sector where purchases can be made in installments, like cars.

Sleazy Car Salesmen

The people who know this human tendency best are car dealers.

Recently, I was chatting with a couple of female clients of mine. One woman mentioned that her daughter was about to buy a new car, and that she was going to go with her daughter so that she didn’t get screwed by the dealership.

I asked her a simple question, “What’s her budget?”

I thought I’d get a number like $20,000 or so. But that wasn’t the answer.

Instead, she said, “Well, she can afford $400 a month.”

When my client’s daughter walks into that car dealership, she will be fought over by the salesmen. They will work the numbers to make the most expensive, attractive car on their lot that catches the girl’s eye to cost only $400 a month (as long as she is willing to pay $400 a month forever.)

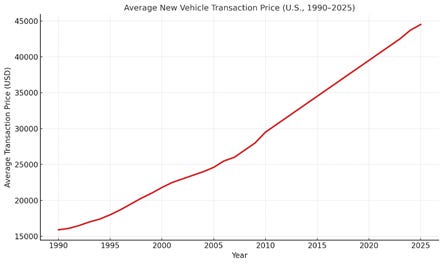

And because people like my client’s daughter have primarily used car loans to buy their cars for decades, the price of cars has risen as well.

This problem is exacerbated when the Federal Reserve (which should be abolished) lowers rates. In the Pandemic zero-interest-rate-policy (ZIRP) era, car prices skyrocketed. New car prices ballooned 27 percent from an average of $38,800 in the first quarter of 2020 to $49,500 only two years later. Used-car prices went up 45 percent in the same period.

Again, cheap money lending means prices go up.

But there’s another item that is purchased with debt that has no interest tied to it. The prices of it are not affected when interest rates or lending policies change. However, it’s clear to see that prices have risen because most people buy it with debt.

And it’s something that you spend most of your day holding in your hand.

Hey, Reader!

I hope you’re enjoying this piece. Stick around for part two, when I answer the question you’ve been asking yourself for years: Why do all these poor people have a newer iPhone than me?

Stay tuned,

John